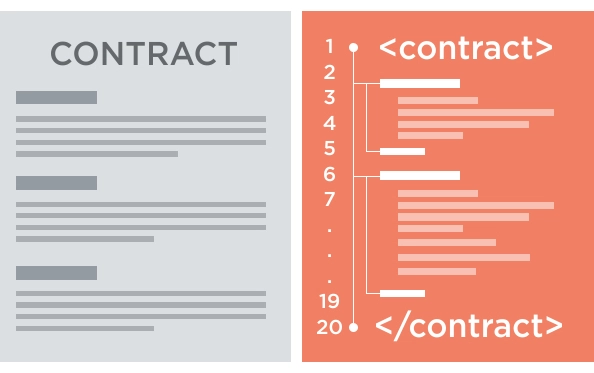

Smart Contracts are the “translation” in software code of a traditional contract, which in this way is automated. In a nutshell it’s possible to verify the existence of certain conditions (check of the basic contract data) and to automatically perform actions (or arrange for certain actions to be performed) when the specific conditions set among the parties are reached and verified.

In short, the Smart Contract is based on a code that ”reads” both the clauses that have been agreed and the operating conditions under which the agreed conditions must occur, and is automatically self-executed when the information relating to the actual situations corresponds to the information relating to the agreed terms and conditions.

Therefore, although the Smart Contract needs legal support for its drafting, its verification and activation do not require such support.

History

Smart contracts have now hit the timelight in association with blockchain, a technology that actually suits their implementation more than anyone else, even if are basically not entirely new. They were already being tested in the 1990s and conceived much earlier, in the 1970s. The term adopted back then was not Smart Contract, but the concept was essentially the same as the one that led to the smart contracts today. The requirement at that time was fairly simple and related to the need to manage enabling/deactivating of a software licence under certain basic conditions. The license of specific software was in fact managed by a digital key that allowed the software to work if the customer had paid for the license and discontinued its operation on the expiry date of the contract. Quite simply, in a very basic way, it was a Smart Contract.

A more common example would be the vending machine of coffee or other products, which everyone has used: the software and hardware of the machine manage the sale of the product, verifying that the desired product is delivered when a preset amount is given by the purchaser.

Nevertheless, until the arrival of blockchain, there was no such advanced technology as to make the Smart Contract a widespread and reliable protocol. Blockchain has proven to be the suitable technology.

Blockchain in insurance

The blockchain (or block chain) is in a nutshell a distributed database (i.e. a transaction log where data are not stored on a single computer, but rather on several machines connected to each other via the Internet, through a dedicated application enabling them to interface with the “chain”) made up of blocks of data storing transactions; to be consolidated within a block, every data, and subsequently every block before being integrated in the “chain”, must be validated through a process.

In contexts with a lot of “red tape”, in contracts, payments, people or companies identification, administration etc., blockchain can be seen as the most extreme frontier of dematerialization, with so powerful scopes that of course both the banking and insurance industries have started to envisage opportunities and carry out some trials.

Blockchain has also been referred to as the “Internet of Contracts”. A decentralized and open system, with no owner, everyone can use the blockchain as a basis for creating further applications, whose decentralized nature makes it impossible to fraud the log data. If something is changed in the book ledger, shared by all participants, anyone can see it, so that irregularities can never be missed. Everyone can see any transactions in the database, and any change can only be made by adding other code lines, then it is recorded; any entry on blockchain is permanent.

So what the blockchain promises to do better than paper overcoming the Latin slogan “scripta manent, verba volant”, is to guarantee information, its origin, its traceability. In a nutshell, this is a digital decentralisation system, which enables a series of online operations without the need for a central authority or intermediaries, offering the possibility of sending, receiving and storing information in a so-called ledger, an untouchable database decentralised and widespread, split among independent parties..

The power of blockchain stems from its ability to nourish new ways for financial transactions, improve existing insurance processes and track (digital) documents. Digital currencies based on blockchains can support many new insurance models, particularly micro insurance and P2P.

The insurance industry is likely to be disrupted by the blockchain in its very founding aspect, the relationship of trust, the link that the whole insurance system is based on through claims management, payments, security, capital and the dissemination of accurate data. A bond that over time appears mainly in paper documents, even though “the bond of trust” is basically an intangible asset.

Smart Contract& Insurance

Most of blockchain’s applications offered to insurance companies can be classified in the Smart Contract category: as mentioned above, these contracts are software, which automatically execute the contract, leading to the development and execution of the latter within a blockchain system.

Experiments in these directions are already being carried out and very often involve the startups.

The French startup Stratumn, for example, raised capital worthing 8 million euros, gaining the C Entrepreneurs fund of BNP Paribas Cardif in the last investment round, and carrying out the most extensive testing of blockchain insurance networks with 14 companies. “Business dealings in insurance often involve several partners – the natural environment of BNP Paribas Cardif in B2B2C. Stratumn’s technology is capable not just of redesigning end-to-end process management, but can also help address privacy compliance issues with its advanced encryption system. We’ re delighted to partner with Stratumn and support its development.” said Thibaut Schlaeppi, Head of Startup relations & investments BNP Paribas Cardif, on the occasion of the investment in Stratumn by the Company’s venture branch.

Earlier, Stratumn together with Deloitte and payment service provider Lemonway, presented a blockchain-enabled solution called LenderBot. Microinsurance tailored to protect customers of services falling within the broad category of sharing economy. LenderBot allows people to purchase customized micro-insurances simply by chatting through the Facebook Messenger App. The aim is to ensure high value products exchanged between individuals, without the intervention of a supervisory authority (super partes) governing the insurance contract.

Japanese insurance giant Tokio Marine & Fire Insurance Nichido, together with the IT giants, NTT Data Corporation, has instead started to test blockchain technology to define policies for business exchanges, mainly sea-based ones.

Further attempts still exist in the Cat Bond sector, derivatives issued by insurance companies to share the risks associated with policies covering natural disasters with other investors. A scope for blockchain technology that Japanese companies Sompo Holdings and Allianz have already tried out.

This is how Alessandro De Felice, President of ANRA (Italian national association of risk mananagers), explained the potentialities of Smart Contract.

“Insurance industry has always been operating through the same model of risk identification, risk assessment and risk transfer at a given price. This may change dramatically with the widespread adoption of ‘smart contracts’, whereby electronic insurance contracts which record specific events on the blockchain and automatically give rise to the correct clause depending on the event. For example, in the case of lost baggage travel policies, the system automatically scans and matches the baggage data with the cancellation or delay data and pays compensation directly without the need for the passenger to notify the desk. Or again, thanks to developments in the 4.0 industrial sector, it will soon be possible to provide for automatic production-related compensation: in the event of a sudden stop of a machinery, a sensor system detects the damage, transmits the data, calculates the loss in production value and the company is exactly compensated for how long the machinery has been out of order, with a widespread and unchangeable record of the event shared by all the parties involved”.

In the coming years, we are likely to see the development of Smart Contracts in the insurance sector in relation to short-term risks, with clear parameters for payments, with low litigation potential and with a simple and pre-set claims management process.

Norton Rose Fulbright: “Smart contracts are expected to be mainly limited to large short-term commercial risks, in particular property and disaster risks, before being used in longer-term markets or retail environments. Smart contracts are likely to be applied in peer-to-peer transactions, as well as B2C2B transactions.

Insurance transactions where actual payment activation and contractual flow in relation to insurance risk are simple, nevertheless having an original structure and high current costs for both the beneficiary and insurers due to the presence of several participants or just a complex structure, are likely to be blatant candidates for the spread of Smart Contracts.

An example of such a transaction could be given by security cat bonds linked to policies covering meteorological or other risks with a parametric mechanism, where the connection of the loss to an event, rather than the actual loss of the policyholder, makes smart contract-based automation possible. In such transactions, payments are triggered on the basis of the physical parameters of a catastrophic event, such as wind speed, location of a hurricane or the size and location of an earthquake.

Over time, Smart Contracts, or crossbreeds between “old-fashion” contracts and smart contracts, are likely to be used more widely, even in the retail market. A range of Internet of Things insurance products already exist on the market, such as smart home products, whereby developers seek to use smart contracts to connect devices with the underlying insurance policy.”

Smart Contracts for Insurance: The Benefits

This is an overview of all the benefits arising out of the application of Smart Contracts in insurance.

Security, transparency, reliability. Thanks to the encryption process, changes or modifications to the blocks already inserted in the chain are not possible; therefore, data stored in the chain will be safe, reliable and tamper-proof. In addition, the blockchain is safe from hacker attacks. Being organised chronologically (blocks are added to the chain in a precise and unchangeable chronological order), it prevents disputes from arising concerning, let’s say, the execution of the different phases of a contract. Fraud is virtually impossible. The terms and conditions of such contracts shall be displayed in full and shall be accessible to all interested parties. There is no way to challenge them once the contract has been entered into.

Reliability and accuracy. One of the main requirements of a smart contract is to record all terms and conditions clearly and in detail. This is a requirement since failing to do so could cause transaction errors. As a result, automated contracts avoid pitfalls of hand-written forms.

Its technical characteristics prevent any loss or damage: even if any of the nodes where the chain is saved were damaged, the others would continue to operate keeping the chain safe, without any data loss.

Speed. No central entity is required to verify the consistency and validity, this occurs with the consent of the network, and a fully-digital solution deletes run times, controls, paper, back-office and operational risks.

Cost-cutting. For both the Company and its clients. Smart contracts should reduce claims management costs, the risk of fraudulent claims and administrative costs for the insurer. As a result, policy prices will fall.

It’s green. Today, companies are increasingly aware of their environmental impact. Smart contracts are totally paper-less and substantially reduce paper consumption, which in the insurance industry is huge and extremely expensive for both companies and the environment.

Storing and Backup. Smart Contract records the essential details of any transaction. Therefore, whenever data is used in a contract, it is permanently stored for future records. In case of data loss, these features are easily restored.

Confidence. As already said, smart contracts inspire full confidence regarding the implementation thereof, providing a sound basis for the customer-company relationship. The transparent, autonomous and secure nature of the agreement removes any potential manipulation, distortion or error. Once concluded, the contract is automatically executed by the network.

All rights reserved