One of the winning choices that an insurance tech startup can make today is to develop technologies for insurance companies, thus remaining in a commercial B2B environment without contact end users. This is because cloud technology platforms are one of the things that insurance carriers are in urgent need, in combination with Big Data solutions.

This is Amodo, emerging Croatian startup in the European insurance tech we had already mentioned long ago as it was one of three winners of the call Open-F@b BNP Paribas Cardif, last December. Is very recent, the news that the startup founded in 2013 and run by Marijan Mumdziev, based in Zagreb, but partially already engaged in the USA, has raised an investment of 500,000 Euros by the Austrian investment fund Speedinvest, thanks to which it will start its international expansion.

What does Amodo do? It has developed a technology platform that let insurance companies to be much more powerful in many respects, especially one, the most important: reaching Millennials.

We are aware that Millennials are the target that today any consumer company has to reach and which are currently unsatisfied customers.

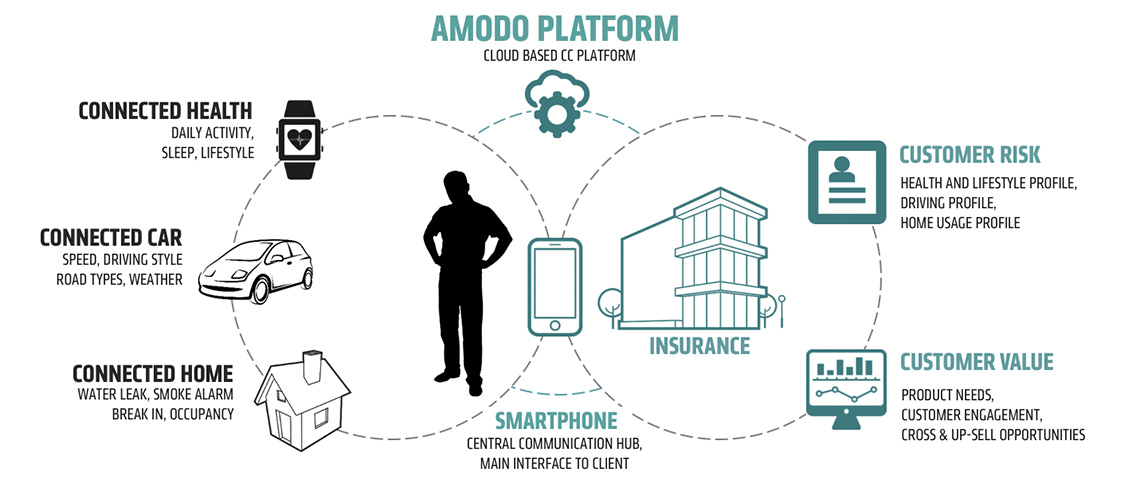

Amodo aims to be a tool to radically change the relationship with this customer segment (and not just this one), since it is able to gather data from smartphones and a range of different consumer devices connected to the network, in order to build profiles of holistic customers, provide better information about the risk exposure and product requirements of the customer. Thus it enables carriers to communicate with these users in a customized manner, suitable to the lifestyle, but also being able to reach it with on the spot policies.

Basically, Amodo collects and analyzes data making them useful to carriers: as we know in the field of big data the real challenge is not the collection of data, but rather the analysis and organization of the same in a predictive manner. Advanced analytics are those which allow insurances to become analytics-driven companies.

The startup has already developed different solutions for companies, Driver Suite (linked to motor insurance) and Health and Lifestyle Suite (related to health and well-being). To be honest, Amodo not only caters to the insurance companies, but also to automotive and telco industries.

Marie-Helene Ametsreiter, one of the investors, Partner and Investment Manager at Speedinvest, said: “Amodo won us over with its innovative business model that brings benefits both to insurances and consumers. We look forward to working with this team and help it to become international”.

play_circle_filled

play_circle_filled